Commercial Real Estate Essentials: The 8 Types of CRE

Commercial real estate (CRE) covers a diverse range of asset types and is defined as property used specifically for business purposes. The primary role of a commercial property is to generate revenue through capital gain or rental income.

While office, industrial, retail and multifamily are considered the main categories of CRE properties, the commercial industry also encompasses hospitality and mixed-use assets, as well as land and special-purpose real estate. Each property group features its own set of distinct characteristics.

Types of Commercial Real Estate

OFFICE

Office space can be described as an environment designed to meet the business needs of its occupiers, who offer management, administrative, financial, educational, medical or other professional services, according to NAIOP. Office properties can house multiple tenants or a single company. Depending on their location, they are typically designated as urban or suburban.

- Urban office buildings: Located in central locations within cities and usually include high-rises/skyscrapers that are taller than 25 stories

- Suburban office buildings: Situated in less densely populated areas outside of city centers and are generally low-rise (with fewer than seven stories) and mid-rise buildings (spanning between seven and 25 floors)

Office space can then be grouped into three classes. Based on the definition provided by NAIOP, these are:

- Class A: Well-located office buildings with rents in the top 30% to 40% of the market. These assets are typically in major employment clusters and provide great access to a wide range of transportation, retail and dining options. Building amenities and services are characterized as above average.

- Class B: Office buildings in good to fair locations in major employment centers, with rents ranging between that of Class A and Class C office properties. Access to transit is also good to fair, with a moderate number of retail and dining alternatives nearby. Building amenities and services can be described as average.

- Class C: Office buildings in less-desirable locations relative to the requirements of major tenants, with rents in the bottom 10% to 20% of the market. Access to transit and area amenities may vary, as these can be moderate-level properties in poor locations or older, depreciated buildings in good locations. Building amenities and services are characterized as below average.

Office space can also be grouped into subcategories such as medical office, life sciences and flex. These specific breakdowns help narrow down and accelerate CRE searches.

INDUSTRIAL

Industrial space is real estate intended for industrial operations and used for manufacturing, storage and distribution, among other uses. Industrial buildings can be single- or multi-tenant, are generally low-rise and can include a certain square footage of office space. Similar to the office category, industrial buildings are also classified as Class A, Class B and Class C assets.

Located outside urban settings, these facilities are ideally situated near major thoroughfares and governed by strict zoning regulations. The main types are:

- Manufacturing: Facilities featuring loading docks, clear heights of at least 10 feet and typically less than 20% office space. Manufacturing includes heavy manufacturing and light assembly facilities.

- Storage and distribution: Buildings that accommodate the storage and shipping of goods to the end-user. This category incorporates distribution warehouses, general warehouses and truck terminals.

- Flex space: Properties designed to be used for a variety of purposes. These facilities usually include more office space (often more than 30%) and can be grouped into research and development space, data centers and showrooms.

Industrial space also includes subtypes such as automotive, data centers and research and development.

RETAIL

Retail properties can be defined as space used to market and sell consumer goods and services. The retail sector had been experiencing a significant transformation prior to the pandemic due to the rise of e-commerce. And, while concepts such as experiential and omnichannel retail take up a large share of the retail industry, traditional retail space still fills an important role in the customer experience.

Retail covers a wide array of property types such as single storefronts, strip/shopping centers, department stores, malls, supermarkets, hypermarkets and restaurants, among others. Retail properties can be:

- Single-tenant buildings, such as big-box stores

- Multi-tenant structures, usually anchored by a lead tenant

- Pad sites with multiple single-tenant structures such as a bank, pharmacy or restaurant

MULTIFAMILY

Multifamily properties are residential buildings that include more than five units and generate rental income. This asset class encompasses subcategories such as condos, townhomes, co-ops and apartment complexes. According to Freddie Mac, the main types of multifamily properties are:

- Garden-style: One- to three-story apartment buildings — with or without elevators — situated in a garden-like setting in a suburban, rural or urban area

- Walk-up: Four- to six-story buildings without an elevator

- Mid-rise: Multi-story property with an elevator, typically in an urban location

- High-rise: Building featuring nine or more floors and at least one elevator

- Manufactured housing: A community in which the operator leases a site to owners of manufactured homes

- Special-purpose housing: Dedicated housing for a certain population segment including senior, student and subsidized housing

Multifamily space can also be classified as Class A, Class B and Class C assets. Apartment and community amenities are important factors in determining a property’s ranking, along with location, the building’s age, condition and occupancy level.

HOTEL

Part of the hospitality industry, the hotel sector consists of establishments that provide accommodation, meals and other services to guests. Based on asset class, hotels can be categorized as limited-service, select-service and full-service, according to U.S. Hotel Appraisals.

- Limited-service hotels: These properties typically have the lowest operating costs of all three segments and room rates are usually at the lower end of the scale.

- Select-service hotels: A combination of limited- and full-service hotels, these establishments offer services and amenities in moderation, while in-room amenities approach or meet full-service hotel levels.

- Full-service hotels: These properties provide a broad range of amenities and services such as on-site restaurants, spas, banquet rooms, extended room service and concierge services. They typically serve meeting and special events requirements as well and command higher operational costs and average rates.

MIXED-USE

Mixed-use properties incorporate multiple uses within a single building or site. The real estate types clustered into a mixed-use property typically comprise a balanced share of the building or site. Common configurations include apartment buildings with a significant share of ground-floor retail or office space; office buildings with ground-floor retail space; or a property combining industrial and office space, among others.

LAND

This category encompasses greenfield or agricultural land; infill land, which is located between existing buildings, typically in dense environments; and brownfield land, which consists of previously developed land that is available for reuse and may potentially be contaminated as a result of its prior utilization.

SPECIAL PURPOSE

Special-purpose real estate includes any type of commercial property that does not fit into any of the categories mentioned above. Amusement parks, parking lots, churches, stadiums and zoos are a few examples of special-purpose assets.

While a more in-depth understanding of each asset type is required when deciding on a potential investment, having a clear view of the types of commercial properties and their characteristics plays an important role in making well-informed business decisions, especially in the current dynamic CRE environment.

Article tags:

More Articles You Might Like

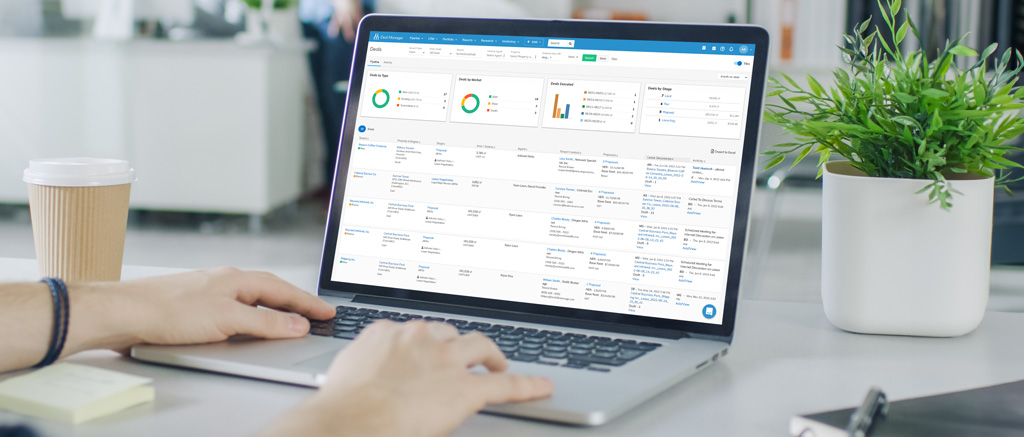

How Deal Manager Maximizes CRE Lease Renewal Success

Managing lease renewals can become much easier with the right tools and technology that save time, reduce errors and increase productivity.

Industrial Construction Continues to Level Off Amid Normalizing Demand and High Interest Rates

New industrial starts in 2023 totaled 314.6 million square feet, down significantly from the 593.2 million square feet in 2022.

How to Find Construction Projects Quickly Using Development Pipeline Data

CRE professionals can gain a competitive advantage by leveraging development pipeline data to quickly find construction projects.